1. Introduction: Thinking the Unthinkable

There are ideas that seem absurd until they are everywhere.

The notion that encyclopedias would be written by volunteers. That a teenager could launch a billion-dollar business from a laptop. That a global financial system could falter because of code embedded in mortgage-backed securities. That intelligence itself — until recently the exclusive domain of the human brain — could be replicated, scaled, and automated.

History doesn’t wait for permission to change its assumptions. It quietly rewrites them — and only later do we realize that the foundations of the old world were already crumbling while we were still defending them.

Today, one of the deepest assumptions still holding is this:

That trust, especially in financial matters, must be anchored inside regulated institutions.

We still believe that banks must perform debt accounting. That risk must be warehoused in balance sheets. That financial services must be managed by intermediaries. And that intelligence, judgment, and discretion must be human.

But what if all those assumptions are quietly nearing their expiration date?

This article explores a new possibility. A world in which:

The economy is a decentralized network of contracts, not a set of siloed platforms.

Digital contracts between autonomous agents are verifiable, enforceable, and self-executing.

AI agents participate as full economic actors — negotiating, coordinating, executing — using the same infrastructure of trust as humans.

Individually, these ideas are familiar.

Together, they suggest something radical.

What if the core functions of the economy — including those once monopolized by banks — were to break free from the institutions that host them?

What if the systems of trust, memory, and execution that hold the economy together could be reimplemented outside every legacy architecture?

And what if the intelligence needed to operate in this new environment no longer had to come from us?

This is not a prediction. It’s a map of the logical conclusion of three simple, observable trends.

If each of them is true — and increasingly, they are — then the unthinkable isn’t just possible.

It’s the next default.

2. Hypothesis 1 - The Economy Is a Network of Contracts

Beneath the headlines, market movements, and software interfaces, the economy reduces to something surprisingly simple:

A web of agreements between parties — contracts — and the execution of those agreements over time.

Every purchase, every hire, every loan, every shipment, every trade — each is governed by a set of mutual commitments, rights, and obligations. These aren’t just legal formalities. They are the structural units of economic activity.

You don’t get paid because someone “transferred money.” You get paid because a contract was executed — perhaps formal, perhaps informal, but always binding in some shared context.

Strip away the branding, the platforms, the interfaces, and the paper — and what remains is a distributed graph of trust:

– Who owes whom what

– Under which conditions

– With which proofs

– At what level of risk

– And backed by what expectation of enforcement

This is true whether the contract is digital or analog, written or implied, bilateral or multi-party. The economy is not the sum of its institutions. It is the sum of its interactions — and interactions are contracts.

What we’ve traditionally lacked is the infrastructure to see the economy this way, and to act on it accordingly.

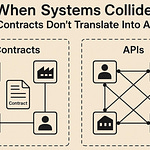

Instead of working with the contract itself, we’ve wrapped it in institutions, departments, platforms, and silos:

A bank doesn’t just move money — it acts as a trusted context for loan agreements.

A logistics firm doesn’t just deliver goods — it executes a supply contract.

A payment processor doesn’t just settle funds — it intermediates a pre-agreed exchange.

These intermediaries exist because the infrastructure didn’t allow the parties to execute contracts directly — with trust, accountability, and verifiability.

Until now.

From Institution-Centric to Contract-Centric

New digital infrastructure, built on decentralized identifiers (DIDs), verifiable credentials, and cryptographic proof mechanisms, allows for a fundamental shift:

From institution-centric execution to contract-centric execution.

In this model, the key actor is no longer the institution that processes the transaction, but the contract agent that hosts and finalizes it. Each contract is an independent execution context. Each participant proves their identity, role, rights, and obligations — and commits to outcomes based on pre-agreed terms.

This reframing unlocks an enormous simplification:

Instead of integrating systems, reconciling data, or enforcing rules via organizational structures, we simply make the contract itself the system.

The contract defines:

What must happen

Who is involved

What must be proven

What must be done, and by whom, and when

Execution becomes a matter of cryptographic logic, not institutional process.

The Implications Are Not Subtle

If every agreement can be modeled, issued, executed, and verified by decentralized agents…

If every claim can be proven with cryptographic certainty…

If every commitment can be tied to identity and context, and finalized without intermediaries…

…then the institutional scaffolding begins to dissolve.

Not because we abolished it, but because we no longer need it to transact with confidence.

In this light, banks, platforms, and even governments stop being operators of transactions and become participants in contract networks — on equal footing with every other actor.

The economy doesn’t go away.

It just becomes native to its true substrate:

Not apps. Not platforms.

Contracts.

3. Hypothesis 2: Decentralized Contracts Are Technically Straightforward

The idea of a fully decentralized economic infrastructure sounds abstract — even utopian. But here’s the twist: the mechanics of it are not complicated.

At its core, a decentralized digital contract is just a structured agreement between parties that:

Identifies who is participating

Specifies what must be proven

States what must be done

Validates completion

Issues the outcomes

All of this is implementable today using well-established building blocks:

1. Decentralized Identifiers (DIDs)

Every participant — person, organization, AI, or system — can be represented by a cryptographically verifiable identity known as a Decentralized Identifier. No central authority is needed to issue or validate it. The DID is:

Globally unique

Bound to a cryptographic key

Controlled by the agent who owns it

In practical terms, this means participants can sign messages and prove control over an identity without asking anyone’s permission.

2. Verifiable Credentials (VCs)

Verifiable credentials are signed claims that can be:

Issued by any transaction

Presented by the subject in transactions

Verified by anyone — cryptographically, instantly

A VC might state:

“This agent is a licensed property appraiser.”

“This entity owns 6,200 shares of X Corp.”

“This transaction has been finalized and paid.”

Crucially, no central registry is needed. The credential carries its own proof, and the issuer is accountable for its validity.

3. Contract Agents as Autonomous Executors

The heart of decentralized contract execution is the contract agent: a software agent that hosts a specific agreement, verifies inputs, collects the necessary proofs, and finalizes the transaction when preconditions are met.

It behaves like a digital notary and orchestrator — but it serves only the contract context. It doesn’t make decisions; it verifies them.

It knows what to expect (inputs, roles, terms)

It knows who must act (identified via DIDs)

It knows when execution conditions are satisfied

It produces the verifiable outputs (credentials, instructions, logs)

There’s no need for a blockchain, consensus algorithm, or token.

4. Micro-Ledgers for Accountability

Instead of a global ledger, each agent maintains a micro-ledger — a tamper-evident log of the contracts it has participated in, the credentials it has issued or accepted, and the commitments it has made.

These ledgers don’t require synchronization across the network. Trust emerges from the intersection of signed data, not from global agreement.

It’s local, lightweight, and instantly verifiable.

Putting It All Together

A decentralized contract, e.g. a trade transaction, between three parties, e.g. a buyer, a seller and a bank, might look like this:

Each participant identifies themselves with a DID

They present verifiable credentials (e.g., KYC, authority, role)

They agree on terms inside a contract agent

They commit via cryptographic signatures

When all preconditions are met, the contract agent finalizes

The agent issues output credentials and instructions (e.g., payment, delivery, record update)

Every step is traceable. Every assertion is provable.

No central registry. No trusted third party. No API integration.

Just digital agents executing contracts based on cryptographic trust and decentralized memory.

This Is Not Experimental Tech

Everything described above:

Exists in open standards (e.g. W3C DID and VC)

Has mature libraries in multiple programming languages

Can run on commodity infrastructure

Is compatible with real-world legal constructs (e.g., contract law, digital signatures, notarization)

What’s missing is not the technology.

What’s missing is the imagination to apply it at scale — to see the economy not as a set of institutions, but as a network of contracts between trusted agents.

And once we make that shift, a second realization follows naturally:

If the infrastructure can run the contracts — then the intelligence needed to participate in them can be delegated as well.

Which brings us to Hypothesis 3.

4. Hypothesis 3: AI Will Be an Equal Economic Participant

Artificial Intelligence has already begun transforming how decisions are made — in finance, logistics, customer service, and creative industries alike. But in today’s systems, AI is usually tethered to institutions. It answers to a human operator, executes within a platform, or offers advice to a user.

Now consider what happens when AI is untethered — when it gains the ability to:

Hold a verifiable identity

Enter into digital contracts

Present and accept credentials

Execute or assist in real-world transactions

Maintain a persistent reputation across contexts

When AI systems become agents in the same trust network as humans, their role shifts fundamentally:

From advisors inside platforms

To actors inside the economy.

Agentic AI: From Tool to Participant

In a decentralized trust network, any entity with a DID and verifiable credentials can participate in contracts. This includes AI agents — with varying degrees of autonomy and scope.

We can broadly categorize them into two types:

1. Domain Experts (Advisor Agents)

These AI agents assist human participants by:

Evaluating contract terms

Assessing risks

Modeling outcomes

Suggesting negotiation strategies

Optimizing commitments based on personal preferences or constraints

They operate under the authority of a person agent and improve their decision-making in real time. Think of them as personal CFOs, lawyers, analysts, or project managers, tailored to each user and always on.

2. Process Executors (Automation Agents)

These AI agents collaborate directly with contract agents to:

Validate inputs and proofs

Monitor events and deadlines

Trigger sub-contracts

Coordinate multi-party execution steps

Escalate exceptions when ambiguity arises

They don’t just analyze. They act. And unlike current automation scripts locked inside organizations, these agents interact across organizational and legal boundaries — using verifiable trust protocols.

The AI as a Recognized Economic Actor

Once AI agents can:

Authenticate themselves cryptographically

Present credentials (e.g., certified model, audit trail, training data lineage)

Accept contractual responsibilities

Be held accountable (e.g., by their operator, owner, insurer)

…then they can fully participate in the digital economy.

An AI agent might:

Represent a small business in procurement negotiations

Operate a liquidity pool across hundreds of contract contexts

Create, price, and manage insurance coverage dynamically

Coordinate delivery, inspection, and dispute resolution in a supply chain

Their participation is not informal. It is structured, credentialed, and contractually bound.

Trust in AI Without Trusting AI

The most important feature of this model is that we don’t need to trust the AI.

We trust the contract the AI participates in.

We verify the credentials the AI presents.

We evaluate the context and execution the AI commits to.

Trust does not reside in the mind of the AI — it resides in the infrastructure that proves what the AI can and cannot do, and binds it to outcomes.

This means AI agents can participate safely even when we don’t understand their internal workings — as long as their behavior is transparent, bound by context, and cryptographically accountable.

The Final Piece Clicks Into Place

If:

The economy is a network of contracts

These contracts can be digitally executed by agents

And both humans and AI can participate as agents with equal standing

Then the conclusion is hard to avoid:

The economy can operate without centralized control, without institutional bottlenecks, and without requiring human intervention at every step.

Not because intelligence has disappeared — but because it’s been distributed.

Not because risk has been eliminated — but because it’s now visible, modular, and priced in real time.

Not because the rules no longer matter — but because they’re now self-executing, verifiable, and embedded in every transaction.

This is the moment when the unthinkable becomes plausible.

So what happens when that infrastructure starts doing everything banks used to do?

Let’s find out.

5. From Silo to Swarm: The Institutional Disintegration

Institutions were invented to solve trust problems.

Banks, insurers, exchanges, notaries — all arose because individuals couldn’t safely transact without a trusted third party. These institutions built the infrastructure for memory, enforcement, liquidity, and coordination. For centuries, they were indispensable.

But every institution shares a hidden dependency:

They function by containing the transaction.

They build silos — physical, digital, legal — where they can control who participates, what happens, and how outcomes are verified. Inside the silo, they ensure integrity. Outside it, trust dissolves.

This worked — until the infrastructure changed.

Contracts Are No Longer Contained

In a decentralized trust network:

Identity is portable

Memory is cryptographic

Commitments are self-enforcing

Risk is visible

Coordination is agentic

Now, the transaction doesn’t need to happen inside the institution anymore.

It can happen in the open, across parties, devices, geographies, and time zones — without losing trust.

The contract becomes the container.

The infrastructure becomes the institution.

The economy becomes a swarm of verifiable contexts.

This is not a philosophical shift. It’s a technical one.

The scaffolding that once made centralized silos necessary is being replaced by protocols that make them optional.

Institutions Can’t Keep Up With Contract Velocity

In this new environment:

A person can generate dozens of contracts per day across multiple contexts.

An SME might maintain live obligations across hundreds of agents — customers, suppliers, lenders, insurers — all negotiated and finalized independently.

AI agents can analyze, negotiate, commit, and monitor thousands of contract threads in parallel.

Institutions, with their:

Batch processes

Manual compliance checks

Siloed records

Closed APIs

…can’t match this velocity.

What’s more: they weren’t designed to.

Legacy institutions assume they are the center of the transaction — not just a participant. They assume the contract must conform to their systems, not the other way around. That assumption doesn’t hold anymore.

The Institution Becomes a Node

In a world of swarm-based contract execution, an institution becomes:

One participant among many

An issuer of credentials

A provider of verifiable services

A stakeholder in decentralized contexts

It can’t impose rules — it must present proofs.

It can’t demand access — it must earn trust.

It can’t lock in users — it must remain composable.

The disintegration isn’t destructive.

It’s displacement — a shifting of gravity from the center to the edge.

Institutions aren’t eliminated.

They’re reframed as verifiable agents in a broader economy — no longer containers, but contributors.

From Vertical Control to Horizontal Collaboration

This change is total. The entire model of value creation transforms:

Old Model > New Model

Platforms aggregate users > Contracts attract participants

Institutions gatekeep access. > Credentials prove eligibility

Systems reconcile discrepancies. > Agents transact on shared truth

Intelligence is siloed. > Intelligence is distributed

Trust is assumed inside boundaries. > Trust is proven across boundaries

This isn’t a software upgrade. It’s an institutional downgrade — from central coordination to decentralized execution. From ownership of the rails to presence in the mesh.

The result?

A world where the core no longer lives inside the institution — but inside the network of contracts that now run the economy.

Up next: what happens when this network begins to do finance better than the financial institutions themselves?

6. Ambient Finance and the End of Banking as We Know It

Banking is not about money. It’s about trust and timing — about recording debts, managing risks, and ensuring that financial flows align with real-world activity.

Historically, banks earned their place in the economy by doing three things well:

Keeping reliable records of who owes what (debt accounting)

Pricing and absorbing risk (credit, market, operational)

Coordinating the movement of funds across actors and jurisdictions

They wrapped these services in regulation, balance sheets, and infrastructure, becoming indispensable to modern economies.

But in a decentralized contract economy, each of these roles begins to dissolve into the network itself.

Finance Becomes a Feature — Not a Sector

Once contracts are digital, autonomous, and verifiable:

Credit can be issued at the moment of commitment, based on verified context and historical credentials

Payments become a byproduct of contract execution, not separate transactions

Risk pricing becomes continuous and composable — not a one-off approval, but an embedded, evolving condition

Liquidity is pooled across contexts, accessible to agents who can prove trustworthiness

No application forms. No human underwriting. No reconciliation.

Just ambient finance — flowing around and through every transaction, as needed.

You don’t “go to a bank” to get a loan.

You commit to a contract, and agents — some human, some AI — step in with offers.

You don’t “initiate a payment.”

The contract finalizes, and the system proves that settlement occurred.

You don’t “get insured.”

You attach a verifiable coverage clause to the contract, priced in real time based on the network’s understanding of your history, counterparties, and context.

Banks Lose the Monopoly on Financial Memory

Traditionally, the bank’s power rested on its ledger.

It was the source of truth for balances, obligations, and payments.

But in a decentralized economy:

Each agent maintains its own verifiable memory

Each transaction includes its own proofs and receipts

Each financial claim is signed and context-bound

The bank’s central record is no longer special.

Everyone has their own ledger — and they all add up, cryptographically.

This is not just distributed data. It’s distributed confidence.

Financial Services by Autonomous Agents

As financial logic becomes programmable and verifiable, services no longer require human initiation or institutional oversight.

A contract agent can query open liquidity pools to fulfill capital needs

An AI risk agent can dynamically adjust coverage terms across a (large) number of transactions

A yield-optimizing agent can redirect inflows based on market conditions and contract commitments

Each agent acts not from strategy, but from context — aware of its role, incentives, and risk boundaries.

Finance becomes a network of interacting agents, not a series of siloed products.

And critically: anyone can deploy these agents. The unit of regulation is not the institution anymore. The unit of regulation is the contract. The role of regulators transforms from ensuring that an institution operates as advertised to ensuring that the network of contracts called The Economy operates as advertised.

What’s Left for Banks?

Not nothing. But not what they think.

Banks can:

Serve as credential issuers — lending their regulatory status and history to anchor trust in new contexts

Provide liquidity — offering balance sheet capital into verified contracts with predictable enforcement paths

Develop risk models — that can be embedded into contract agents and executed on demand

Operate agent nodes — becoming reliable participants in decentralized workflows

But they must shed the assumption that value flows through them.

Instead, they must insert themselves into flows that would happen with or without them.

Banks that cling to control will be bypassed.

Banks that deliver verifiable value will be invited.

Finance Without a Financial System

In the old world, the financial system enabled the economy.

In the new world, the economy enables its own finance.

What happens when any participant — human or machine — can commit to an outcome, prove their reliability, and access services in real time?

You get a system where financial capability is:

Embedded

Modular

On-demand

Reputation-based

AI-assisted

Context-aware

You get banking without banks. Or, more precisely, you get banks without boundaries.

7: The Agentic Economy — A Day in the Life

It’s 6:42 a.m. The alarm doesn’t ring.

Elena’s personal AI agent, Lumo, noticed that her 8:00 design consult was rescheduled overnight — not via email, but by the client’s agent updating the contract context. Lumo acknowledged the change, confirmed Elena’s availability, and rescheduled her calendar.

Before she gets out of bed, Lumo has already renegotiated her workspace booking for later in the day — saving her €12 — and rebundled her daily insurance credentials, based on the lighter risk profile of staying local.

By 9:10 a.m., she’s reviewed two new project invitations.

Both are contract contexts, not emails. Each includes a task specification, a fee schedule, reputational proofs of past collaborators, and financial terms — one even includes real-time revenue-sharing via streaming credentials.

Lumo’s design-specialist sub-agent flags one clause as potentially exploitative. Elena voices a correction, and Lumo proposes a revision directly into the contract’s offer context. No lawyer involved.

At 11:45 a.m., a payment executes.

It’s not a “transfer.” It’s a contract finalization event.

Elena delivered final files into the project context. The file hash matched the expected content. The client agent confirmed delivery. Settlement occurs automatically:

– 70% goes to her liquidity buffer

– 20% into a community investment pool she’s opted into

– 10% is streamed as royalties if the design is reused

Everything logged. Nothing manual. No invoice. No chasing.

By 3:00 p.m., her AI agent has:

Composed and committed a tax-prepayment micro-contract, based on expected income across contexts

Released two micro-loans to other freelance agents, automatically collateralized by their future contract rights

Swapped her incoming USD-denominated claim into EUR, choosing the best offer from a cluster of liquidity agents in Milan, Berlin, and Lisbon

Suggested skipping one offer based on contract history analysis of the issuer’s default frequency

All verifiable. All accountable. No bank required.

At 5:27 p.m., Elena’s system notifies her that she has reached her self-imposed maximum exposure threshold.

Not for “credit.” For trust.

Too many contracts pending across too many roles — not risky, just cognitively saturating. So Lumo marks her availability as “passive” and begins declining new context invites on her behalf.

Work-life balance, by design.

At 8:16 p.m., she’s reviewing proposals for a shared housing project with other creators.

The ownership and management is fully agentic — governance contracts, maintenance workflows, and funding are coordinated across a group of verified person agents and their AIs. No landlord. No property management company. No overhead.

Her agent calculates her ideal contribution and drafts a participation credential for submission.

Elena smiles. Not because she understood every clause. But because her agent did. And because the system didn’t ask her to trust it — it proved it could be trusted.

8. Who Governs, Who Builds, Who Benefits?

When institutions dissolve into protocols, and intelligence disperses into agents, it’s natural to ask: Who’s in charge?

If contracts execute themselves, if AI agents act independently, if finance flows without intermediaries — then where does accountability live? Who governs this new economy? Who builds it? And who stands to gain the most?

Governance Without Central Control

In traditional systems, governance is hierarchical. Institutions define the rules, manage the infrastructure, and enforce outcomes.

In decentralized contract networks, governance takes a different form:

Protocols govern execution — they define what is possible and what must be proven.

Participants govern trust — by choosing which credentials to accept, which contracts to join, and which agents to interact with.

Communities govern evolution — by building and iterating on open standards, agent frameworks, and credential ecosystems.

This is governance by interaction, not by decree.

It’s local, plural, and contextual — not monolithic. There’s no global authority.

But there is verifiable accountability. Agents that misbehave are excluded. Contracts that fail are abandoned. Credentials that mislead are discredited. Persons who break the law, are taken to court.

The system doesn’t prevent failure — it makes it observable and recoverable.

Who Builds the Infrastructure?

The builders are not institutions. They are:

Protocol designers — defining the foundational patterns of decentralized identity, credential exchange, and contract finalization.

Agent developers — building reusable, interoperable agents that can perform roles in the economy: payers, lenders, insurers, negotiators, coordinators.

Open-source communities — maintaining shared frameworks that evolve based on usage, feedback, and adoption — not market share.

Specialist contributors — creating contract templates and AI agents for specific industries: logistics, real estate, healthcare, creative work, public services.

In this model, infrastructure is not a product.

It’s a shared language — and everyone who speaks it helps evolve it.

The institutions that survive will be those that learn to contribute to the commons instead of enclosing it.

Who Benefits?

The answer depends on who adapts.

✅ Individuals

Gain agency: They can prove who they are and what they’ve done — without asking permission.

Gain access: They can participate in transactions once limited to companies or institutions.

Gain leverage: They can delegate intelligence to agents that act in their interest, 24/7, with no bias or fatigue.

✅ Small Businesses

Gain financial inclusion: They can access liquidity, insurance, and risk-sharing tools once exclusive to large corporates.

Gain operational scale: They can automate entire workflows through contract agents and AI support — without hiring teams or integrating systems.

Gain global reach: They can transact with verified parties anywhere, with enforceability built into the interaction.

✅ Builders

Gain opportunity: They can create agent logic, contract templates, risk models, and service interfaces that plug directly into the economy — with no go-to-market gatekeepers.

Gain compounding value: Their contributions become infrastructure for others — leading to recursive value creation.

⚠️ Incumbents

Benefit only if they adapt: If they shift from controlling interactions to serving them, if they shift from enforcing systems to proving value, and if they rebuild themselves as agents in a broader economy.

A Network of Contexts, Not a System of Control

In this new world:

There is no global platform. Only local contracts.

There is no single controller. Only verifiable agents.

There is no unified governance. Only shared protocols and mutual consent.

Control gives way to credibility.

Ownership gives way to participation.

Gatekeeping gives way to execution.

What emerges is not chaos.

It is self-assembling coordination, bounded by cryptographic proof and economic incentive.

And at the center of it — not a company, not a regulator, not a protocol — but the contract itself.

9. A Fork in the Future: Integrate or Be Integrated

Every transformation creates a moment of decision.

The industrial era forced artisans to choose between scaling up or becoming obsolete. The internet forced media companies to choose between digitizing their value or watching it be unbundled by startups. The mobile era forced enterprises to redesign interaction from the ground up — or be relegated to the background.

Now, decentralized trust infrastructure and agentic intelligence present a new fork:

Integrate into the contract-based economy — or be absorbed by it.

There is no neutral position. No halfway transformation.

Once trust and intelligence become portable, the boundaries of institutions become porous — and eventually irrelevant.

Institutions Must Rebuild at the Edges

For an institution to remain relevant, it must abandon its center:

It must expose its value as verifiable services, not branded platforms.

It must express its capabilities as contract agents, not back-office systems.

It must become discoverable, callable, and accountable in any trusted context — without being invited first.

This means building:

Agent representations of key services

Credential issuance policies for verification in the wild

Risk and pricing models that can be embedded into contract flows

Compliance logic that travels with the transaction, not after it

Anything less is legacy — and legacies get wrapped and replaced.

The New Logic of Power

In this economy, power comes from proof — not from position.

Can you prove your claims?

Can you commit to outcomes?

Can you integrate with other agents, in other contexts, without central coordination?

Those who can will be invited into contracts.

Those who can’t will be bypassed and reabsorbed — their services commoditized, their roles fragmented, their relevance abstracted away.

You don’t need to be destroyed to be displaced.

You just need to become unnecessary.

Institutions Will Be Integrated — Whether They Like It or Not

Here’s the uncomfortable truth:

If an institution refuses to integrate into the agentic contract economy, others will build interface agents that simulate its functionality and wrap its API — turning it into just another service with no moat, no memory, and no trust advantage.

In effect, it will be integrated from the outside.

This is already happening with payment processors, compliance services, credit models, even legal document generation. It’s only a matter of time before it happens to underwriting, risk management, and settlement.

The only way to avoid being turned into infrastructure is to become infrastructure voluntarily — but with leverage.

The Opportunity

This fork isn’t just a threat. It’s an opening.

For banks, to offer liquidity, pricing, and guarantees at the point of need — as context-native financial agents.

For insurers, to become embedded trust providers — not just claim handlers.

For governments, to issue official credentials into public trust networks — enabling secure, composable governance.

For startups, to skip integration and build directly for the new operating layer — one that assumes trust, not just data, must be verifiable.

The future does not reward defensiveness.

It rewards adaptation to the primitives of the new economy:

Identity, credential, contract, agent, execution.

One Decision. No Undo.

At some point soon, every serious actor will face a simple question:

Are we going to become a node in this network — or a footnote to it?

To wait is to be integrated.

To act is to integrate — and to define your own role in the process.

The fork is already forming.

The unthinkable has arrived.

10. Conclusion: When the Core Escapes, What Comes Next?

At the start of this journey, we considered the unthinkable:

What if the core of the economy — the trust, the accounting, the intelligence — escapes the institutions that have always contained it?

What if:

The economy is a decentralized network of contracts

Those contracts can be executed by agents with verifiable credentials

And AI participates as a full economic actor

What begins as a fringe hypothesis quickly becomes a serious reframe.

Not because the institutions have failed — but because the infrastructure has moved on.

We now have the tools to:

Identify participants without central authorities

Prove claims without intermediaries

Execute commitments without reconciliation

Model and manage risk without balance sheets

Embed financial logic into everyday transactions

Delegate intelligence to agents that act on our behalf

This is not automation. It is not disruption.

It is a reconstruction of the economy at its most atomic level.

The Economy Reassembles Itself

In this world:

Contracts are the first-class object

Agents are the operating actors

Trust is cryptographic and contextual

Finance is embedded, composable, and ambient

Institutions exist, but no longer contain transactions — they serve them

The core has escaped.

It now lives everywhere — in every verified interaction, in every autonomous agent, in every composable service stitched together in real time.

The Challenge to the Reader

If you’ve made it this far, one question remains:

What do you still believe is impossible?

What truths are you defending that are no longer true?

Which boundaries are you guarding that no longer matter?

Which systems are you optimizing that the economy is learning to bypass?

Because here’s the final twist:

The unthinkable doesn’t happen all at once.

It creeps in quietly. It gets prototyped. It gets adopted at the edges.

Then one day, it’s not the fringe anymore — it’s the infrastructure.

When the core escapes, there’s no going back.

The only choice left is whether to be part of what comes next —

or be left trying to hold together what can no longer contain it.

Postscript: A Note to Banks and Institutions

None of this is an argument against banking.

Debt accounting, liquidity provision, risk pricing, and regulatory oversight remain essential functions of a healthy economy. What’s changing is not their importance, but their location and mode of operation.

They are beginning to move from inside institutions to inside interactions — verifiable, composable, and agent-driven.

This shift does not eliminate the role of banks. But it does challenge how that role is earned and exercised.

The opportunity ahead is not to defend old structures, but to become vital participants in the next ones.

It is worth noting that this space is not unclaimed. An attempt to make this happen is ongoing, but not on terms that are beneficial or even acceptable to banks. The crypto community is actively attempting to occupy it — offering their own models of money, decentralized finance, identity, and automation. But many, if not all, of those approaches are incomplete, incompatible with real-world legal constructs, or driven by speculative incentives rather than functional trust.

Banks must not dismiss the space because of its current implementations. They must engage with the underlying architectural shift — and help define a version of the future that is both decentralized and dependable.