1. Introduction: What Money Has Always Been

Most people, even many professionals in finance, think of money as a substance. We speak of “having money,” “moving money,” or “creating money,” as if it were a tangible object or a digital file passed between devices. But money has never been a thing. It is a relationship - a guaranteed agreement between parties, an abstract expression of trust, and above all, a system for settling obligations. More precisely, money is the contract that settles all contracts.

This may sound like a philosophical abstraction, but it has very practical consequences. Once we begin to see money for what it really is - a guaranteed multi-party contract backed by a trusted issuer - we gain a clearer view of what is required for money to work in a digital economy. It is not enough to tokenize existing balances or replicate paper-based models with code. A meaningful digital transformation of money must begin with the understanding that money is the finalizer of other contracts. It enters the scene at the moment when all else is agreed, performed, and validated - and ensures that the result is legally, fiscally, and economically complete.

That moment of finalization is not a side-effect of a payment - it is the outcome of a process involving multiple parties: buyers, sellers, intermediaries, financiers, and often the government itself. Every transaction creates obligations. Money is what resolves them.

Historically, we have built massive institutional machinery around this function. From the central bank’s balance sheet to the cashier’s till, from letters of credit to real-time gross settlement systems, all of it exists to fulfill this simple idea: when a deal is done, there must be something that everyone agrees settles it.

In the digital world, however, that agreement is no longer a handshake. It is a verifiable interaction. The contract is software. The participants are agents. The ledger is a microcosm of identities, credentials, and roles. In that context, money must not just be represented digitally - it must become part of the digital contract it settles.

This article explores what that means: how understanding money as a contract, not as a token, reframes digitalization, exposes the limitations of today’s so-called digital currencies, and reveals a path forward - toward a financial system where business and monetary finality are no longer separate layers, but a single verifiable process.

Let us start with the core function of money - its true and enduring role in the economy.

2. The Function of Money in the Economy

Money serves many purposes in economics textbooks - unit of account, store of value, medium of exchange - but in practice, its most critical function is often overlooked: settlement.

Settlement is not just payment. It is the moment when a transaction is done, not just agreed. Liabilities are extinguished. Risk disappears. Trust is no longer required, because performance has been delivered and acknowledged. This is the role that money plays - not in theory, but in every finalized transaction in the economy.

The clearest example is simple: you receive a good, and you pay for it. The act of payment, assuming it is successful, settles the obligation. The seller has no further claim; the buyer has no further duty. The contract - spoken or written - is closed. From a legal and accounting perspective, this moment is everything.

But money does not just settle bilateral contracts. In reality, most transactions involve multiple parties. A buyer may depend on credit. A seller may involve a supplier. A payment provider may intermediate. Taxes are incurred. All of these add layers of obligation. Yet, we still look to money to act as the finalizer. We expect the right kind of money to make everything whole.

This is why proper money must account for time. It must support immediate settlement (cash) and deferred settlement (credit). It must allow for risk and trust to be managed dynamically between actors. Whether a contract is settled now or later, the promise to settle must be expressible in a form everyone accepts. That form is money.

Importantly, this also means that money is always contextual. We rarely just “have money.” We have it in specific accounts, under specific conditions, subject to specific rights and obligations. The moment money is used, it interacts with a context: a contract, a jurisdiction, a time frame, a counterparty. It is not neutral or abstract. It carries weight, meaning, and history.

Finally, because nearly every transaction creates a tax implication, money brings the government into nearly every contractual relationship, whether as an observer, beneficiary, or enforcer. The role of money in the economy is thus not purely private. It is the state’s mechanism for ensuring that it can collect what is owed. That is why legal tender status matters. It is not symbolic - it ensures that all obligations, public and private, can ultimately be brought to rest.

So when we speak of “digital money,” we are not just discussing a change in format. We are confronting the question: can this new form of money settle obligations - fully, finally, and legally - in a digital multi-party environment?

Most proposals cannot. But before we examine them, we must understand what truly changes when contracts themselves become digital.

3. Digital Contracts Require Digital Money

In a digital economy, the very nature of the contract is changing. Agreements are no longer confined to PDFs, scanned signatures, or verbal promises recorded in email threads. Increasingly, contracts are software - executable, verifiable, and connected to real-world systems through APIs and digital credentials.

These digital contracts, implemented e.g., as finite state machines, bring precision and speed to business relationships. They allow terms to be enforced automatically. They reduce ambiguity. But they also introduce a new dependency: the settlement of these contracts must itself be digital, verifiable, and final.

This is where most current thinking about digital money falls short.

It is often assumed that once a business process is digitized, a separate payment process can simply be appended to the end of it. But that mindset is a holdover from the analog world, where a contract and its settlement were always handled in separate systems - one legal, one financial.

In the digital world, that separation is not sustainable. If the contract is digital, then the means of settlement must be part of the same digital execution flow that happens in the same trust framework. Otherwise, the automation breaks down precisely where it matters most: at the moment of finality.

True digital money, then, is not just money that can be sent electronically. It is money that can natively participate in the execution of a digital contract. It must understand the identities involved, respond to programmable terms, respect conditional logic, and provide a verifiable signal that the obligation has been settled - legally and completely.

This requirement has profound implications. It means that digital money must interact directly with the contract logic itself, not just with a ledger. It must be issued, transferred, and recognized within the structure of multi-party digital agreements. It must work not just for payments, but for settlements, which may involve escrow, sequencing, dispute resolution, or regulatory checks.

And most importantly, it means that the digitalization of money cannot be separated from the digitalization of business contracts. To digitize one is to digitize the other. You cannot settle a verifiable contract with unverifiable money.

This is the unspoken upgrade that the digital economy demands. We have digitized communication. We have digitized identity. We are beginning to digitize contracting. The next essential step is to digitize settlement itself - not with new tokens, but with money that understands and fulfills the finality of digital obligations.

As we will see next, this is precisely where many of today’s so-called digital currencies fall short.

4. The Myth of Digital Money

The term “digital money” is everywhere now. It features in central bank policy papers, fintech roadmaps, crypto whitepapers, and payment innovation pitch decks. But in most cases, the label is misleading.

A payment rail that moves balances electronically is not the same as a system that settles obligations inside digital contracts. Nor is a token on a blockchain, no matter how fast or programmable. These are payment instruments, not settlement mechanisms in the full contractual sense.

Two prominent examples illustrate the point: central bank digital currencies (CBDCs) and stablecoins.

CBDCs are often presented as the future of government-issued money. Yet what most CBDC designs offer is simply a new payment interface - one that may emulate physical cash in a digital wrapper. They may offer privacy or retail access improvements, but they rarely, if ever, address the integration of money into the contract execution layer. A CBDC balance may be moved between wallets, but it is not typically tied to the lifecycle of a digital contract, nor does it natively support programmable, verifiable settlement flows.

Stablecoins may go a step further in programmability but stumble at the same foundational point: guarantee and finality. The value of a stablecoin depends on external reserves or algorithms. Redemption may be uncertain or restricted. And crucially, the legal status of stablecoin-based settlements remains ambiguous. Can a tax liability be extinguished with a stablecoin? Can a judge compel acceptance? Usually not. That means, by definition, they cannot reliably settle digital contracts - they can only simulate partial payment.

Both CBDCs and stablecoins fail the test of true digital money because they operate outside the contract context. They are not instruments of settlement embedded within the digital agreement. They are adjacent to it - bolted on via APIs or callbacks. As a result, the most important moment in the lifecycle of a transaction - the moment when all obligations are resolved - remains fractured across systems.

This is more than a technical flaw. It reflects a conceptual gap: a failure to see that digitalization is not about digitizing assets in isolation. It is about digitizing interactions -contracts, relationships, obligations, and resolutions. Without that, digital money remains just a faster version of the old world, unable to meet the demands of the new one.

To close that gap, we must first confront a foundational reality: in the real economy, the state is always involved in settlement, because it is a party to most transactions - through taxes, regulations, and legal enforcement. Any money that cannot acknowledge and fulfill that role is incomplete.

That’s the next piece of the puzzle.

5. The Role of the State in All Settlement

Every meaningful transaction in the formal economy includes an invisible third party: the government. Whether it’s a small retail sale, a complex financial contract, or a cross-border supply agreement, a tax liability is almost always born at the moment of finalization. This makes the state a silent participant in nearly every business interaction.

This fact carries an important implication: money must be acceptable not just to the primary contracting parties, but to the state. It must be capable of settling not only commercial obligations, but public ones - most importantly, tax.

That’s why legal tender status matters. It is not merely a formal designation. It is what ensures that a particular form of money can be used to settle all debts - private and public - without further negotiation. Without legal tender status, a payment may satisfy a counterparty’s preference but still leave the tax authority unpaid or unacknowledged.

This is not an edge case. In a digital economy, where business transactions are automated and instantaneous, compliance is no longer a back-office task - it is part of the transaction itself. Finalizing a contract without resolving the tax implications is no longer acceptable. Everything must settle together, in one verifiable interaction.

That requires money to be more than just a digital balance. It must be:

Recognized by the state as final,

Capable of producing a receipt or credential that proves settlement, and

Interoperable with fiscal systems that compute and collect tax liabilities.

This is one of the key weaknesses of both stablecoins and narrow-purpose digital tokens. Even if they are accepted by counterparties, they are not backed by legal guarantees that satisfy the state. A smart contract might release goods or services, but if the money used is not recognized for tax purposes, the transaction remains incomplete from a legal standpoint.

By contrast, traditional commercial bank money - recorded in accounts, regulated by public authorities, and underpinned by deposit insurance and central bank access - is considered final. It carries the implicit and explicit guarantees required for full settlement. The challenge is not replacing this foundation with something else, but rather translating it into a form that can participate in digital contracts - programmably, verifiably, and in real time.

In this light, legal tender is not an obstacle to innovation. It is a prerequisite for it. If we want a programmable future, one where obligations can be created, negotiated, and settled automatically, we must ensure that money itself can meet the same standard of verifiability and legal finality as the contracts it settles.

This brings us to the heart of the matter: what kind of money do we actually need to support digital contract settlement? And what principles should guide its design?

6. Design Principles for Native Digital Money

If money is to settle digital contracts - not just fund them or move balances - then it must meet a new standard. It must be designed not for transmission, but for participation in execution. The requirements of this role are more demanding than those of traditional payment systems, but they are also more precise. What emerges is a set of design principles for native digital money - money that can operate inside the logic of modern economic activity, not outside of it.

1. Legally Binding and Verifiable

At the most basic level, digital money must be capable of producing proof of settlement that is recognized not just by counterparties, but by courts, auditors, and tax authorities. A mere balance transfer or token movement is not enough. The settlement must be verifiable, with cryptographic evidence tied to identities, time, and contract terms. This makes the settlement outcome not just visible, but binding.

2. Operates Within a Digital Contract Context

A native digital currency must not stand apart from the contract - it must operate inside it. That means the contract must be able to reference the monetary obligation, call the settlement function, and receive a confirmation of success or failure - all as part of the same verifiable execution flow. In other words, the settlement becomes a step in the contract, not an external consequence of it.

This also implies identity awareness: the money must “know” who is paying whom, in what context, for what purpose, and under which conditions. Only then can it serve the legal and tax requirements that depend on such information.

3. Supports Both Immediate and Deferred Settlement

Time is not a secondary concern - it is essential. Some transactions settle on the spot (cash), while others rely on promises (credit), staging (escrow), or conditional release. Native digital money must support the full spectrum of temporal commitments. That means it must be able to represent both immediate finality and future enforceable claims. Credit and debt are not add-ons; they are integral components of a functioning economy.

4. Finalizes Transactions, Not Just Transfers Balances

This is perhaps the most critical distinction. A balance transfer can be reversed, disputed, or misaligned with the business logic it was meant to fulfill. A true finalization, by contrast, closes all obligations. It reconciles tax, updates all parties’ ledgers, and produces an immutable receipt that can be shown to any interested party, including the state.

Digital money that meets this standard is not just a financial instrument. It becomes part of the contract infrastructure - the machinery that makes modern commerce work.

5. Can Be Embedded in a Trust Network, Not Controlled by a Platform

Finally, the architecture of digital money must reflect the reality of modern economic interaction: no single party should control the system. The design must allow multiple autonomous agents to interact, each verifying the contract, the data, the identities, and the money independently. The money must integrate into a trust network, not depend on a centralized ledger or a proprietary payment platform.

This redefines the role of money - from a tool used after a contract is executed, to a component that enables contract execution in the first place.

The only question remaining is: what kind of architecture can support all of this?

That’s where we turn next.

7. Money in the Internet Trust Layer

When digital contracts become the primary interface for economic activity, we must ask: who executes the contract? who verifies it? and who settles it? The answer cannot be a single platform, authority, or blockchain. It must be a network of agents - each acting on behalf of a participant, each verifiably performing its role, and each capable of recognizing when a contract has been fulfilled.

This is the design philosophy of the Internet Trust Layer (ITL). In this architecture, money does not float above the contract as an afterthought. It is embedded within the contract, executed as a verifiable action inside the flow of obligations.

Agents and Contexts: The Architecture of Digital Settlement

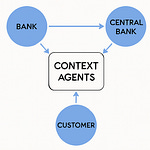

In ITL, there are two main types of agents:

Person Agents, which represent natural or legal persons and act on their behalf,

Contract Agents, which orchestrate a specific transaction or contractual context.

Every transaction is a verifiable interaction between these agents. Each action - whether it’s committing to deliver a service, reserving funds, or performing settlement - is tied to a specific contract context and logged to the micro-ledger of the agent.

Digital money, in this setting, is simply one of the actions a Person Agent commits to. But it is not just a transfer - it is a credential, issued as proof of having fulfilled a monetary obligation. The recipient agent can verify it cryptographically. The Contract Agent records it as part of the contract execution. And when all parties have issued their respective proofs, the contract is finalized - and the settlement becomes real.

This is not an abstraction. It is a two-phase commit model grounded in verifiable credentials, digital identity, and legal accountability:

Each participant reserves their obligations - monetary or otherwise - and issues a signed commitment.

Once the Contract Agent receives all required commitments, it issues the outputs: the final, signed records that confirm the contract is settled.

From Payment to Finality

The ITL model avoids the common trap of viewing payments as separate from contract execution. Instead, money is treated as one verifiable component among many: alongside delivery confirmation, regulatory compliance, and tax declarations.

Because all of these are digital credentials, they can be checked and chained together. This produces a full, auditable, and legally valid record of who did what, when, and under what terms. No additional reconciliation is required. No third-party clearing or messaging system is needed. Settlement is the final state of the contract.

Interoperability Without Centralization

This design also avoids the fragility of centralized trust registries, proprietary networks, or single-token schemes. Every agent maintains its own ledger, its own keys, and its own verifiable identity. Yet all can interoperate using shared protocols. This ensures that trust is always grounded in the agent’s own guarantees - not in the authority of a platform or network operator.

In such a system, money regains its essential role: not as a data packet to be routed, but as the finalizer of obligations. And because it is digitally issued, signed, and verified, it satisfies not only the parties to the transaction, but also the legal and fiscal systems that govern the economy.

This is what real digital money looks like: not programmable tokens, but verifiable obligations inside verifiable contracts.

And this, in turn, points to the larger shift already underway.

8. Conclusion: The Next Infrastructure Shift

Money has always been infrastructure. Not just an asset or a tool, but a system that enables settlement - a system that works precisely because it is accepted, enforced, and trusted by all relevant parties, including the state.

That system is now facing a transformation, not because we want faster payments or digital wallets, but because contracts themselves have changed. We are moving from a world of paper and intermediaries to a world of software, where obligations are defined, negotiated, and executed entirely within digital environments.

This shift reveals a simple truth: if the contract is digital, the settlement must be too. Not in the superficial sense of sending a digital token, but in the deeper sense of producing a legally binding, verifiable, and final resolution to the transaction - one that satisfies every party involved, including regulators and tax authorities.

What we need, then, is not just digital money, but native digital money - money that operates inside digital contracts, supports immediate or deferred obligations, integrates seamlessly with identity and verification systems, and produces finality at the moment when it is most needed.

This is not a technical upgrade. It is a redefinition of what money is and how it functions. It takes us beyond the illusion of tokenized assets and into a world where economic activity is itself a network of verifiable digital contracts, and money is the contract that settles them all.

In that world, the separation between financial logic and business logic disappears. Contract, performance, and settlement become one continuous process. Auditing becomes verification. Compliance becomes architecture. Trust becomes a feature of the system, not an external requirement.

And money becomes what it always was at its best: a shared agreement that brings finality to our interactions - now implemented natively in the digital realm.

This is the next infrastructure shift. It will not be driven by speculation or slogans. It will be built by those who understand that in a digital economy, the only kind of money that matters is the kind that can settle a legally binding contract.

That's what commercial banks should do. Now.