Introduction - A Ledger Is Not Enough

In the rush to digitize the economy, we’ve done something both bold and revealing: we’ve tried to rebuild trust with code.

The systems we’ve created - public blockchains, smart contracts, tokenized assets - promise immutability, programmability, and disintermediation. They promise to remove friction, reduce reliance on centralized institutions, and unlock entirely new forms of coordination. These are important ambitions. And yet, they rest on a critical assumption: that economic activity can be faithfully represented as a sequence of verified state changes.

This assumption is worth examining.

Because the real economy - the one businesses operate in, the one banks finance, the one regulators oversee - is not built from tokens or transfers. It is built from contracts: enforceable commitments between parties with known identities, negotiated terms, and asymmetric responsibilities. These relationships are not abstractions - they are the legal, operational, and financial fabric of every functioning market.

The question, then, is not whether we can build ledgers that record movement. We can. The question is whether those ledgers reflect the economic relationships they’re meant to serve. Whether they preserve the duality of obligation and claim, the accountability of known participants, and the flexibility required to deal with ambiguity, breach, and change.

Many current digital systems fall short. They record ownership without responsibility. They execute logic without context. They automate without understanding.

This article is an attempt to surface that problem - not to reject innovation, but to guide it more faithfully toward what the economy actually is. It argues that our foundational tools - like double-entry accounting - emerged not from mathematical cleverness, but from the need to represent human agreements in verifiable form. And it asks whether today’s infrastructure is doing the same - or losing economic meaning in the pursuit of technical purity.

What follows is not a technical critique, but a structural one. It explores what we’ve abstracted away in the name of decentralization, and what we might need to recover if we’re serious about building systems that can handle not just tokens, but trust.

Chapter 1 - The Shape of Economic Reality

At first glance, the economy appears to be a vast system of value transfers: money moving between accounts, products exchanged for payment, assets bought and sold, services billed and paid for. But look more closely, and the picture becomes far more nuanced. Beneath the flows and balances lies a dense fabric of contracts - agreements between identifiable parties that define obligations, expectations, contingencies, and rights.

Whether explicit or implicit, every meaningful transaction in the economy is governed by some form of contract. These can be formal and enforceable - like a loan agreement, an employment contract, or a lease - or informal and relational, like a tab at a local café or a handshake agreement between business partners. What unites them is the presence of mutual obligation: one party agrees to do something, provide something, or pay something, and another party agrees to reciprocate.

This layer of contractual commitment is what gives economic activity its structure and meaning. It’s not the flow of value that defines the economy - it’s the relationships that make those flows necessary, valid, and enforceable. And these relationships are always situated in context: between specific parties, under specific terms, often within specific jurisdictions. They’re not interchangeable. They’re not fungible. They’re not anonymous.

It is precisely this structure - who owes what to whom, and under what terms - that accounting systems have sought to record and maintain. Double-entry bookkeeping, introduced in the 15th century, was not merely a way to keep tidy ledgers. It was a breakthrough in modeling the relational nature of economic obligations. Every debit has a credit. Every entry reflects a claim mirrored by a responsibility. Each participant’s ledger makes sense only in reference to someone else’s.

This system of recordkeeping didn’t just improve internal control - it enabled trust. Businesses could grow beyond local familiarity because their obligations were transparently documented and verifiable. Partnerships could scale. Trade could flourish. Disputes could be resolved with reference to a shared set of accounts.

And critically, accounting became a derivative layer: it wasn’t the economy itself, but a structured trace of it. It didn’t describe what people agreed to, but what they owed as a result. In mathematical terms, it was a first-order approximation of the real economy - one that translated complex human agreements into structured, auditable data.

Seen this way, the real economy is not an abstract system of balances and tokens. It is a living network of relationships: contracts, participants, roles, and consequences. It is not enough to know that a transaction occurred. We must know who was involved, what was promised, and how it fits into the larger web of obligations.

Any digital system that claims to represent economic activity must contend with this. It must answer: Can it model the relational depth of real commerce? Can it preserve the identity, intent, and accountability that underlie all meaningful obligations? Can it represent not just motion, but meaning?

This is the standard against which we must evaluate not just blockchains, but any new infrastructure for digital finance. Because if we lose this layer - if we treat the economy as just a sequence of transfers - we risk severing economic activity from its most important feature: the ability to hold each other accountable.

And without accountability, there is no trust. Without trust, there is no economy - only movement.

Chapter 2 - What Blockchains Actually Model

Blockchains are often described as “trustless” systems. The term is meant as praise - suggesting that one no longer needs to rely on intermediaries, institutions, or even identifiable counterparties to carry out transactions. Instead, trust is replaced by cryptographic proofs, distributed consensus, and immutable ledgers.

But trustless doesn’t mean structureless. Every system, no matter how decentralized, still models something. It still encodes assumptions about what matters, what should be recorded, and what needs to be verified.

So, what do public blockchains actually model?

At their core, they model state transitions between pseudonymous addresses. A typical transaction consists of a token moving from one address to another, governed by a set of deterministic rules enforced by the network. The system verifies that the sender has the required balance, that the transaction is properly signed, and that it follows the prescribed format.

This is an elegant solution to the narrow problem of asset ownership. It ensures that tokens can be transferred without duplication or fraud. It keeps a global, synchronized log of balance changes. And it does all this without needing to know who the participants are, what their relationship is, or why the transfer is happening.

But therein lies the limitation.

Public blockchains record what happened - not who was involved, what they agreed to, or what obligations exist before or after the transfer. The ledger shows a movement, but not a motive. It captures a change in state, but not the context that gave rise to that change.

This makes blockchains a kind of zeroth-order approximation of economic activity. They capture the surface trace - the visible artifact of a deeper transaction - but not the transaction itself. The ledger shows that tokens moved. It cannot tell you whether that movement represented a payment, a loan, a refund, a settlement, a gift, or a mistake.

Even more fundamentally, blockchains collapse the distinction between value and liability. When you hold a token, the system treats it as your asset. But it doesn’t (and can’t) record who stands on the other side of that asset as the liable party. There is no embedded counterparty. No named issuer. No enforceable promise. Just a balance.

This makes sense in systems like Bitcoin, where tokens are defined by scarcity rather than obligation. But it becomes problematic when applied to things like stablecoins, tokenized deposits, or real-world financial instruments. These instruments derive their value not from scarcity, but from an enforceable claim on someone else’s balance sheet. When that claim is stripped of identity and legal accountability, what remains is not a financial instrument - it’s a disconnected symbol.

Blockchain systems also struggle with symmetry. In proper accounting, every action taken by one party has a mirror entry in the records of another. Each has a verifiable claim or obligation. But blockchain transactions often model only one side of this relationship. The receiving party may gain an asset, but the originating party’s obligation is not always recorded - or even identifiable.

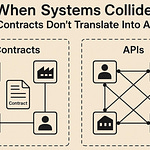

In other words, blockchains model transferability without relationship. They prioritize movement over meaning. This is not a flaw in the engineering - it is a design choice rooted in a particular vision of trust: one that assumes trust can be minimized by removing identity and enforcing uniform rules across all participants.

But real economies are not symmetrical, anonymous, or context-free. They are built on roles, identities, agreements, and asymmetries - employer vs. employee, borrower vs. lender, buyer vs. seller. They rely on intent and interpretation, not just code execution. And when things go wrong, they fall back on systems of adjudication that operate on context, not just syntax.

This is not to dismiss the achievements of blockchain systems. They solve a very specific problem with great elegance. But if we want to model the economy itself - not just asset ownership, but obligation and trust - then we must ask whether a system that records movement alone is enough.

What’s missing is not technical sophistication. What’s missing is the contractual layer - the layer where economic meaning is created, interpreted, and enforced. Without it, we are left with a perfect record of a world that no longer contains the information we need.

And that record, no matter how immutable, is no substitute for understanding.

Chapter 3 - Smart Contracts and the Myth of Self-Enforcing Logic

As blockchains evolved, so did their ambitions. Where early systems like Bitcoin focused purely on value transfer, newer platforms introduced smart contracts - programmable scripts that execute autonomously when certain conditions are met. For many, this seemed like the breakthrough needed to model real economic relationships. Logic could now be embedded directly into the ledger. Contracts would be “trustless,” self-executing, and immune to interference.

But this promise - compelling as it sounds - rests on a dangerous misconception: that enforceability can be replaced by execution, and that legal meaning can be reduced to machine logic.

In theory, a smart contract is code that lives on a blockchain and executes deterministically. Once deployed, it runs exactly as written, without reliance on courts, authorities, or even user intervention. This rigidity is often framed as a benefit: the rules are clear, the outcomes predictable, and trust is outsourced to the machine.

In practice, however, most real-world agreements are not deterministic. They involve ambiguity, context, negotiation, and occasionally disagreement. Contracts between people or organizations often require interpretation - not just about what was said, but about what was intended. Exceptions arise. Circumstances change. New information comes to light. Enforcement is not just about what the words say but how they should apply in a particular situation.

Smart contracts are not contracts in the legal sense. They are automated agents, executing code according to rules written by developers - often with limited understanding of the business, legal, or regulatory context in which that code will be used. They do not (and cannot) handle disputes. They cannot determine whether a breach has occurred unless that breach is already fully expressible in code. And when they fail or behave unexpectedly, the results are irreversible by design.

This rigidity has led to real-world consequences. Smart contracts have been exploited due to bugs, misaligned incentives, or unforeseen edge cases. In many cases, the execution was “correct” from the system’s perspective, but deeply unjust from the human perspective. And once deployed, correcting such contracts is difficult, if not impossible - particularly in public networks where upgrades require broad consensus.

Furthermore, smart contracts assume inputs are trustworthy, but this is rarely true in practice. External data - such as prices, interest rates, or delivery confirmations - must be injected through “oracles,” which are centralized points of failure. In other words, even “trustless” contracts rely on trusted intermediaries. The boundary between digital determinism and real-world ambiguity is not clean - it must be bridged, interpreted, and ultimately governed.

Another often-overlooked limitation is that smart contracts don’t inherently know who the parties are. Most operate on pseudonymous addresses, which makes enforcement, taxation, and compliance difficult or impossible. This is fine in narrow, closed contexts, but becomes a problem when such systems interact with the real economy, where identity and accountability are essential.

To call these systems “contracts” at all risks conflating two very different concepts:

A legal contract is an agreement between identifiable parties, interpreted according to principles like good faith, fairness, and intent.

A smart contract is an automated script with no understanding of who the parties are, no sense of fairness, and no flexibility to adapt.

What’s missing isn’t computational power. What’s missing is meaning.

The real economy runs on agreements that reflect human realities: asymmetric power, negotiated risk, evolving relationships, and shared context. These agreements rely on trust - but not blind trust. They rely on verifiability, recourse, and shared norms about how to resolve uncertainty. These are not weaknesses to be coded away. They are structural necessities.

Smart contracts do not eliminate trust. They simply displace it - from known counterparties and legal institutions to anonymous developers and opaque execution environments. The question is not whether we should use code to automate economic relationships, but how much abstraction we can afford before we lose the very notion of accountability.

Self-executing logic is powerful. But without the ability to interpret, to contest, or to appeal, we are no longer executing contracts. We are submitting to scripts. And scripts, no matter how elegant, do not understand the economy. They merely act within it.

Chapter 4 - The Collapse of Double-Entry Semantics

For over 500 years, double-entry bookkeeping has served as the invisible scaffolding of the modern economy. It allowed merchants, financiers, and eventually institutions to coordinate complex obligations across time and space. The breakthrough wasn’t just that every transaction had two sides - it was that every transaction recorded a relationship between distinct agents: a credit for one party, a debit for another.

This symmetry wasn’t a clever trick. It was a model of trust. It enabled counterparties to see how their books aligned. It made audit possible, fraud detectable, and disputes resolvable. And it gave rise to the financial institutions we still rely on today - not because it was imposed by law, but because it worked.

Against this backdrop, public blockchain systems seem deceptively similar. They keep ledgers. They record transactions. They ensure balances are correct. But when examined more closely, what they provide is not double-entry accounting. It is something far more primitive: a distributed asset tracker that only sees one side of the story.

Here’s the key difference:

In double-entry bookkeeping, a transaction always involves two agents - and both record the economic event from their own perspective. If I loan you $1,000:

I record a receivable (an asset)

You record a payable (a liability)

There is no ambiguity. The entries are linked by identity, intent, and enforceability. That relationship defines the transaction.

On a blockchain, the same transfer might look like this:

Address A sends a token to Address B

There is no built-in distinction between payment and loan. No terms. No roles. No enforceable obligation. The system records only that something moved - not why, not under what conditions, and not with what consequences.

This makes blockchain ledgers fundamentally non-relational. They do not capture bilateral symmetry. They do not distinguish between asset and liability. In many cases, the entire concept of liability disappears. Tokens are held, transferred, or burned - but they are never owed.

This becomes especially problematic when attempting to represent instruments like:

Deposits (which are liabilities of a bank to a customer)

Stablecoins (which are claims on an underlying issuer)

Tokenized debt (which must be reflected on both lender and borrower books)

In each case, the blockchain may show that someone holds an asset - but it does not, by default, record who is responsible for honoring that claim. The liability side of the entry is either absent, implicit, or handled off-chain - meaning it cannot be audited or enforced using the system’s own primitives.

Even where attempts are made to simulate double-entry logic, they tend to rely on token wrappers, intermediary contracts, or manual attestations. But these are overlays - not foundations. The base protocol remains agnostic to counterparty structure.

What’s worse, this design encourages a kind of accounting illusion: the idea that digital assets can exist in isolation, free from entangled responsibilities. That you can tokenize a loan without modeling the borrower. That you can issue a dollar-backed stablecoin without modeling the liability. That you can pass around obligations like poker chips, without ever asking who stands behind them.

This breaks the most basic principle of accounting: that every claim must be someone’s commitment.

The consequences aren’t just theoretical. They show up in practice:

When an exchange collapses and users realize their balances weren’t matched by assets.

When a stablecoin de-pegs because its issuer has no enforceable obligations.

When a tokenized asset disappears and no one can identify the responsible party.

Without double-entry semantics, ledgers become blind to responsibility. They show what is held, but not what is owed. They track movement, but not meaning. They enable transfer, but obscure trust.

Accounting has always been about more than keeping score. It is a shared representation of economic reality - structured so that each participant can see their obligations in relation to others. It is the foundation upon which both trust and accountability are built.

To discard that structure in the name of decentralization is to unmoor finance from the very thing that makes it reliable. It is to drift toward opacity under the illusion of transparency.

A blockchain may show that a token moved. But unless it can also show why, and who stands behind it, it is not an accounting system.

It is just a list.

Chapter 5 - Recovering Economic Meaning in Digital Infrastructure

The pursuit of digital trust has produced some of the most ambitious technological efforts of our time. From global consensus protocols to smart contract platforms and decentralized finance primitives, the underlying vision is clear: build systems where value can move freely, reliably, and without central authority.

But as we’ve seen, movement is not meaning, and ownership is not obligation. The promise of decentralization - real, transformative decentralization - won’t be fulfilled by simply making transfers faster or ledgers more tamper-proof. It will be fulfilled only when digital infrastructure begins to faithfully model the relational structure of the real economy.

That means returning to first principles.

The economy is not a flow of tokens. It is a network of enforceable agreements between actors with identities, intentions, and roles. A sale is not just a transfer of goods - it’s a contract between a seller and a buyer. A payment is not just a debit and a credit - it’s a performance under a larger obligation. A balance on a ledger is not just a number - it’s the consequence of a claim, a risk, a history.

What gives digital infrastructure value is not automation for its own sake, but its ability to support trustable, verifiable interaction between parties. And that trust is not found in code alone. It emerges from the ability of the system to represent:

Who is involved

What was agreed

What each party is expected to do

What happens when things go wrong

In other words, we need to reintroduce context - not as a bolt-on feature, but as a structural layer.

This doesn’t mean abandoning automation or programmability. It means grounding those capabilities in systems that preserve identity, intent, and counterparty structure. It means designing digital contracts that are legible to both machines and humans. It means ensuring that every transaction has a perspective from each party - and that those perspectives are verifiable, symmetric, and enforceable.

Critically, it also means abandoning the fantasy of neutrality. No digital financial system is neutral. Each makes tradeoffs about what it preserves and what it erases. A system that erases identity also erases accountability. A system that models only assets and not liabilities enables opacity instead of clarity. A system that records execution but not agreement substitutes determinism for consent.

We do not need more innovation in token standards. We need innovation in relationship modeling. We need architectures that allow businesses to structure agreements, verify terms, and execute performance - all while preserving the bilateral nature of economic reality.

The goal is not to rebuild legacy finance. It is to surpass it - by preserving its foundational strengths while eliminating its inefficiencies and gatekeepers. That means keeping the accounting symmetry, the contractual enforceability, and the role-based clarity. And it means doing so without reintroducing centralized choke points.

There are efforts underway to make this shift. Technologies that use verifiable credentials, decentralized identifiers, and agent-based interaction protocols are beginning to hint at a new paradigm - one in which trust is not outsourced to the crowd, but grounded in relationships, and where contracts, not consensus, are the final authority.

But for now, we are still in a transition period - caught between the allure of tokenized abstraction and the demands of real-world accountability.

If we want digital infrastructure to serve the economy, we must model the economy as it is: relational, contextual, and enforceable. Not just code. Not just consensus. Not just cryptography.

What we need is meaning.

And meaning, as it turns out, has always lived in the contract.