Abstract

Most digital trust infrastructure today is modelled after centralized or globally coordinated systems. It relies on static registries, hierarchical authorities, and shared ledgers that assume trust must be declared, stored, and maintained externally. But what if trust didn’t require a global source of truth? What if trust emerged dynamically - from the act of transacting itself?

This article explores a radically different approach: a decentralized trust network in which every interaction is a self-contained transaction context. Within each transaction, identities are verified, commitments are made, and verifiable credentials are issued. These outputs are not dependent on, or written to, any global ledger but shared selectively, becoming reusable proofs in future interactions.

Over time, the network evolves organically - each agent navigating and extending a growing web of verifiable relationships. There is no central registry. No global consensus. No need for rollback. Just a stream of finalized, immutable interactions that build trust through use, not proclamation.

I argue that this emergent model offers a simpler, more resilient foundation for digital trust - one that mirrors how real-world relationships work: locally contextual, interaction-driven, and anchored in verifiable experience.

1. Introduction: Rethinking Digital Trust

Trust is foundational to every transaction, from paying a bill to signing a contract or boarding a plane. In the physical world, we build trust over time - through repeated interactions, reputation, documentation, and social or legal frameworks. But in the digital world, we’ve taken a very different route.

Most digital trust infrastructure is designed to answer a single, rigid question: “Who do you trust?” The answers are encoded into global directories, certificate hierarchies, and ledgers. You trust what’s on the list. If it’s not listed, or the list is compromised, you’re out of luck. This approach, while pragmatic in the early internet, has grown increasingly brittle, expensive to maintain, and incompatible with real-world complexity.

The assumption underlying these systems is that trust must be maintained globally. Whether through a central registry, a consensus algorithm, or a permissioned ledger, we’ve tied the concept of trust to static artifacts and global coordination.

But what if that assumption is flawed? What if trust is not a global state, but an outcome of a local interaction?

Imagine a network where each transaction defines its own context of trust. Where participants come together to interact, verify each other, commit, and exchange signed credentials. These credentials are issued, used, and reused as necessary - but not published to a central location. They exist only as evidence of what actually happened, usable by those who need to rely on them.

This is the premise of a different kind of trust network - one that grows from the edges, not the center. One that doesn’t rely on global agreement or static truth, but on verifiable local interactions.

In this model, trust is not stored. It is generated. Not imposed, but earned. Not global, but composable.

And over time, the network of these transaction-based trust relationships evolves into something powerful: a living, decentralized web of trust.

This article explores how such a network works, why it changes the nature of digital trust, and what it means for those building the next generation of business and governance infrastructure.

2. The Old Model: Registries, Ledgers, and Static Trust

The dominant models for digital trust today were designed to solve real problems in the early internet. They answered key questions like: How do I know this website is genuine? How do I know this document was signed by a specific person? How do I make sure a message hasn’t been tampered with?

The solutions were structural: establish a global registry of trusted authorities. Create certification hierarchies. Publish public keys. Distribute revocation lists. Maintain ledgers. Make trust an infrastructural service.

For certain constrained use cases, these models work. DNSSEC secures domain names. X.509 certificates underpin HTTPS. Public blockchains make some types of public proof possible.

But in more complex, multi-party interactions - especially in business, government, and cross-organizational collaboration - this old model breaks down. It’s not because of cryptographic weakness. It’s because the model assumes that trust can be predefined, stored, and made globally visible in advance.

Let’s look at the key assumptions:

1. Trust must be globally known.

Everyone must agree on who is trusted and why. This assumes shared context, shared policies, and shared infrastructure.

2. Trust is static.

Once issued, a trust artifact (like a certificate or token) must be published and remain valid until revoked. This creates administrative overhead, privacy concerns, and fragility.

3. Trust is authority-centric.

A small number of entities get to define trust. Everyone else must defer to them. This introduces bottlenecks, economic gatekeeping, and systemic risk.

4. Trust requires consensus.

Many systems treat trust as a single source of truth: a ledger, a registry, or a blockchain. But consensus systems don’t scale well in the face of privacy, subjectivity, or business diversity.

These assumptions lead to systems that are expensive to operate, brittle to update, and blind to context. Worse, they leave most real-world relationships out of scope, because trust in the real world is often partial, situational, and earned through interaction.

We don’t keep a ledger of everyone we’ve ever trusted. We judge based on past experience, known references, and relevant facts. And we only disclose what’s needed, to those who need it.

In trying to make trust machine-verifiable, we made it rigid. We built trust systems that behave like passports, when most of the time we need something more like conversation.

The good news? That’s fixable, not by abandoning verification, but by relocating it.

Instead of storing trust, we can generate it at the point of interaction. Instead of trusting a registry, we can trust a transaction. And instead of depending on a central source of truth, we can build a web of trust from the ground up, one verifiable interaction at a time.

3. The Shift: Transactions as the Unit of Trust

What happens when we treat transactions - not registries or consensus - as the atomic unit of trust?

A profound simplification.

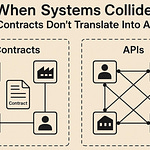

In a transaction-centric trust network, every interaction happens within a clearly defined context. That context is established by a digital contract - a structured agreement between identifiable parties that includes:

Who is involved (with verifiable digital identities),

What is being agreed upon,

What conditions must be met,

What commitments are required from each participant, and

What outputs (credentials) will be issued once the agreement is finalized.

Each transaction proceeds like a miniature protocol:

1. The parties exchange proofs about themselves and their authority to participate.

2. Each participant prepares their commitments (e.g. funding a payment, digitally signing a document, reserving inventory).

3. Once all conditions are met, the responsible contract agent finalizes the transaction and issues verifiable credentials as outputs.

4. These outputs can then be used in future transactions as trusted inputs.

There is no shared ledger. No broadcasting. No consensus algorithm. And no need for rollback. If a transaction doesn’t complete - for example, if someone fails to provide a required proof - it simply doesn’t move forward. Nothing breaks. Nothing is left in an inconsistent state.

This mirrors how real-world agreements work: the deal either goes through, or it doesn’t.

By scoping all trust to the boundaries of a single transaction, you gain several key advantages:

- Privacy: Only the participants involved in the transaction see the details.

- Autonomy: Each participant verifies what they need to trust - no global approval needed.

- Composability: Outputs from one transaction become inputs to another. Trust accumulates.

- Resilience: There’s no global state to corrupt, compromise, or overload.

What emerges is not a static, top-down system - but a living, evolving network of verified commitments. One where trust isn’t handed out from above, but created through use.

In this model, trust is not something you “have.” It’s something you “show” - with proof, in context, when it matters.

Each transaction is a snapshot of trust: a closed, verifiable, composable moment of agreement between independent agents. And just like snapshots in versioned databases, these moments don’t mutate or disappear. They simply exist, ready to be referenced, reused, or left behind.

This isn’t just a technical shift. It’s a conceptual one. A move away from the belief that trust must be globally declared, and toward the insight that trust is always local - anchored in real interaction.

4. Emergence Instead of Imposition

In a traditional system, trust is imposed. A central authority publishes a list of who is trusted. A root certificate defines who can speak for whom. A consortium maintains a ledger that others must rely on. The logic is top-down: trust flows from an established source, and everyone must conform.

But in a transaction-centric trust network, trust emerges.

It emerges from interaction, from behavior, and from verified evidence of performance. There is no one place to declare trustworthiness - there are only places to demonstrate it.

Let’s make this concrete. Imagine a small business contracts a shipping company to deliver goods. Within their transaction:

The business verifies the carrier’s license and insurance via digital credentials.

The carrier verifies the business’s payment method.

Both parties agree to a delivery schedule, confirmed in a digitally signed contract.

Upon successful delivery, both receive credentials recording the outcome.

No one needed to consult a central registry to approve this transaction. No one had to “register” the interaction. And no one else even needs to know it occurred - except the parties involved and anyone they choose to share it with.

Now, suppose a new customer wants to work with the same carrier. They ask for proof of past successful deliveries. The carrier provides a verifiable credential from the previous transaction. If the new customer trusts the issuer of that credential (the small business), that’s enough.

Trust has propagated - without any centralized enforcement.

Over time, this happens over and over again. Every interaction adds more verifiable history to the network. Not a broadcasted history, but a permissioned one. Each agent builds their own trust graph: a personalized, contextual view of whom to trust, in what circumstances, and based on what evidence.

And just like that, the network starts to resemble something living:

There is no single root of trust, but many.

There is no global ledger, but millions of local proofs.

There is no authoritative list, but a web of verifiable claims.

This isn’t just a more scalable approach. It’s a more natural one. It mirrors how trust actually works in human societies: not by decree, but through reputation, experience, and choice. And it offers something the old model never could: a way to adapt.

Because trust isn’t static. It grows, shifts, breaks, and heals. A rigid structure can’t keep up. But a flexible network of local decisions can.

This is the promise of emergence. Not chaos - but complexity managed through modularity. Not an absence of rules - but rules scoped to context. Not abandonment of verification - but verification that travels with the transaction.

In such a system, trust doesn’t need to be imposed. It just needs to be allowed to emerge.

5. The Anatomy of a Trust Graph

What does a decentralized trust network actually look like?

Not like a blockchain. Not like a directory. And not like a hierarchy.

It looks like a graph - a dynamic, evolving structure made up of nodes (agents) and edges (verifiable interactions). Each connection is created when a transaction succeeds and produces a credential that can later be used as proof.

Let’s break down the anatomy.

Nodes: The Agents

Every node in the trust graph is an autonomous agent. It could be:

A person or legal entity (via a Person Agent)

A business application or service (e.g. a logistics system, a payroll platform)

A Contract (Context) Agent that defines the rules and logic of a specific transaction

Agents have decentralized identifiers (DIDs), and can prove control over them. They do not need to register anywhere to exist. Their trustworthiness is based entirely on how they behave in the network - what they do, not who they claim to be.

Edges: The Credentials

Edges in the graph are created when one agent issues a verifiable credential to another - typically as the output of a successful transaction. A credential could be:

Proof of payment

Confirmation of delivery

Authorization to act on someone’s behalf

Certification of compliance or insurance

Any structured claim backed by cryptographic signature

Each credential includes:

The issuer (who signed it)

The subject (who or what the credential refers to)

The claim (what is being stated)

The context (metadata about the transaction or policy rules)

Edges are directional and verifiable. They don’t need to be public to be useful. They just need to be available to those who need to rely on them.

Paths: Contextual Trust

Trust in the graph is not transitive by default. If Agent A trusts a credential from Agent B, and Agent B trusts C, that doesn’t mean A automatically trusts C. Instead, A can evaluate C using the verifiable trail of credentials that connect them.

Every agent assembles their own view of the trust graph based on:

What credentials they have access to

What policies they use to evaluate claims

What relationships they consider meaningful

This means trust becomes deeply contextual and personalized. Two agents may view the same third party differently, depending on their prior experiences, policies, or risk tolerance.

No Central Perspective

There is no master map of the network. No complete registry of who trusts whom. Every agent operates on partial information - yet that’s not a weakness. It’s a reflection of reality.

The system is inherently permissioned, private, and resilient. There’s no single point of failure. No bottleneck. No global truth to be attacked or forged. Instead, the trust graph emerges as a byproduct of interaction. The more agents transact, the richer and more useful the graph becomes. And over time, this growing fabric of verifiable claims begins to replace the need for static trust artifacts entirely.

Reputation is no longer something you declare. It’s something you demonstrate - through the edges you’ve earned in the graph.

6. Implications: Power, Privacy, and Resilience

A decentralized, transaction-driven trust network doesn’t just change architecture - it reshapes incentives, governance, and control. When trust is no longer issued from a central authority but emerges from interactions, power moves to the edges. Privacy becomes a native feature. And resilience is built into the structure.

Let’s examine these shifts more closely.

Power: Trust Becomes a Verb

In traditional systems, power accumulates around whoever controls the registry, the certificate authority, or the ledger. They decide who is allowed to exist in the network and who is not. They define trust by inclusion - and exclusion.

In the emergent trust graph, no one grants permission to participate. Each agent can transact, issue credentials, and verify others based on its own policy. Trust is dynamic and earned - not assigned.

This rebalances power:

No one entity can deplatform you.

Reputation is not bought - it’s built.

Even newcomers can gain trust quickly through verifiable action.

Organizations don’t need to convince the world they’re trustworthy. They just need to prove it in each context, to each counterpart. Trust becomes plural and contextual, not singular and imposed.

Privacy: Contextual by Design

Traditional trust systems often require over-disclosure. To prove one thing, you must share everything:

To prove age, you reveal your name and address.

To prove ownership, you disclose identity and account details.

To be trusted, you must become visible.

But in a transaction-based network, every credential can be scoped, minimal, and purpose-specific. You can:

Present only the part of the claim that’s relevant.

Selectively disclose based on who is asking and in which context.

Rely on zero-knowledge proofs or derived credentials to answer yes/no questions without revealing the source data.

Privacy becomes a structural outcome of the model - not an afterthought. Since trust is evaluated in context, there’s no need to expose global identifiers or publish credentials beyond what’s necessary for the transaction at hand.

Resilience: No Single Point of Failure

Centralized trust systems are vulnerable by design. A single compromised authority can impact millions. A single outage can paralyze an ecosystem. A single false entry in a registry can cause catastrophic failures.

But in an emergent trust network:

There is no central ledger to corrupt.

There is no root certificate to revoke.

Every credential lives with its issuer and can be verified independently.

If one participant misbehaves or disappears, the rest of the network keeps functioning. Other agents can route around problems. Trust continues to flow, even as individual nodes change.

And because all trust is based on verifiable credentials and cryptographic proofs, there’s no need to “undo” anything. Just stop using what you no longer trust.

This architecture is naturally tolerant to failure, deception, and change. It doesn’t prevent all bad behavior - but it makes it easy to detect and route around it. Together, these shifts redefine how trust systems operate.

From authority to autonomy

From disclosure to discretion

From control to collaboration

And they open the door to a future where trust infrastructure can scale with the complexity of the real world - without collapsing under its weight.

7. Conclusion: A Living Trust Network

Trust is not a thing you can store. It’s not a property you can assign. It’s not a badge you can wear indefinitely. Trust, in its most honest form, is what people choose to rely on - based on context, evidence, and experience.

In the digital world, we’ve spent decades trying to approximate that truth using static infrastructure: directories, certificate chains, permissioned ledgers, global registries. And while these mechanisms helped bootstrap trust online, they carry the heavy burden of centralization, rigidity, and fragility.

The model explored in this article offers a different path: one where trust is not a fixed structure but a flow - of credentials, proofs, agreements, and actions. A decentralized network where each interaction is a self-contained context, each credential a verifiable artifact, and each participant a node in a growing, evolving web.

This network doesn’t need to know everything about everyone. It only needs to know what’s true in each moment, between those involved. It doesn’t need to reach consensus on a global state. It just needs to finalize contracts locally and move forward. It doesn’t rely on broadcasting trust. It builds trust by doing.

And perhaps most importantly: it mirrors the way the real world already works.

When you meet someone new, you don’t consult a global ledger. You evaluate based on what they show you, who vouches for them, and how they behave. That’s not a weakness of human systems - it’s a feature of human relationships. And now, we can replicate that feature in digital infrastructure.

The result is not chaos - but order, defined transaction by transaction.

Not opacity - but selective transparency, anchored in verifiable data.

Not a lack of trust - but trust that emerges from interaction, not imposition.

In this world, the trust network is not something we build and then govern. It’s something we participate in and contribute to. It grows as we use it. It adapts as we interact. It strengthens as we rely on it.

It is not a database, a blockchain or a registry. It is a living trust network. And it is already beginning to take shape.