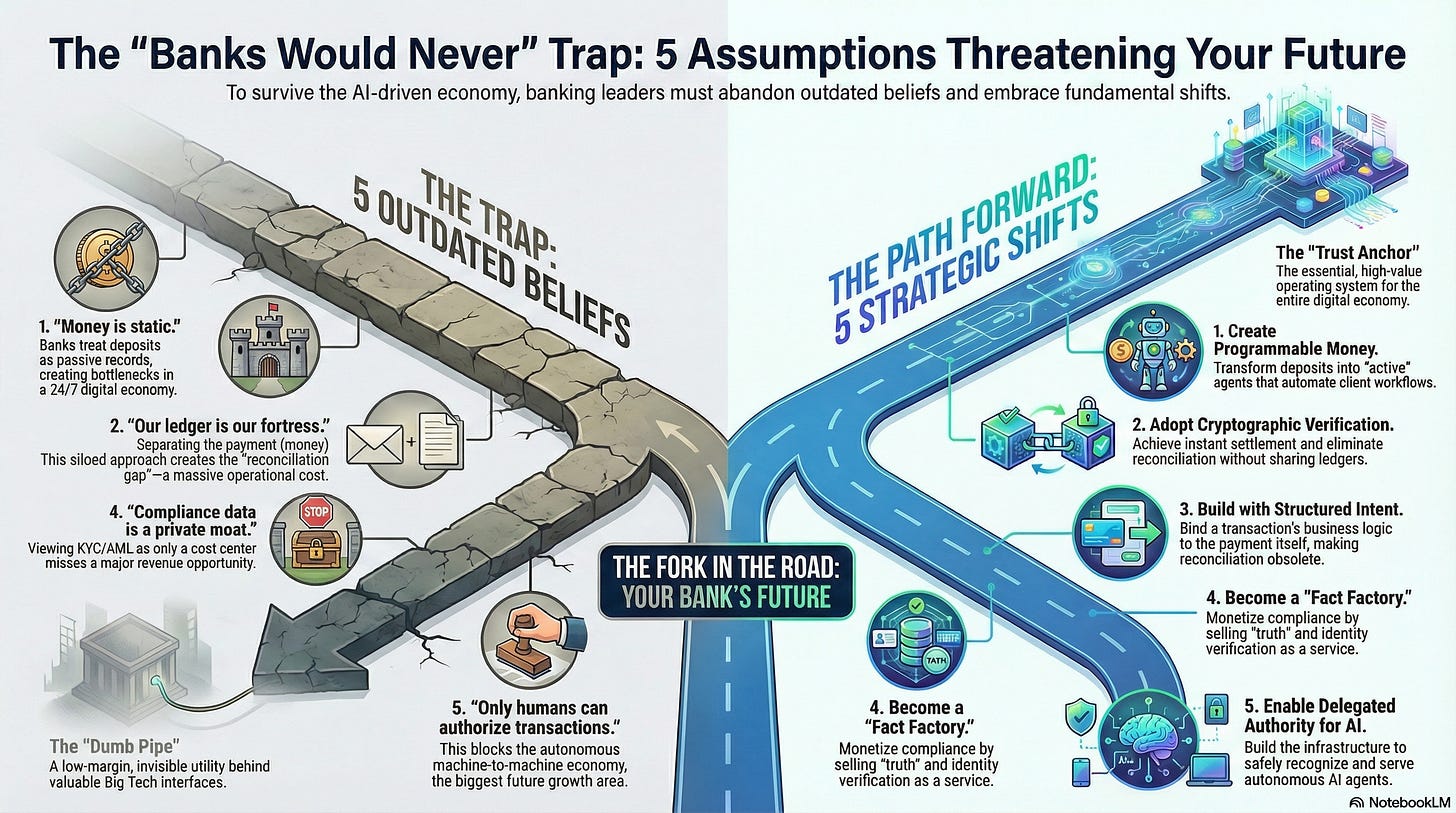

1. Introduction: The Warning Signal

A fellow banking professional recently said to me: “All great changes in the banking industry start with the words ‘Banks would never...’”

It is a profound observation. That phrase usually signals the exact moment a comfortable monopoly is about to face an existential technology shift. History is littered with these defensive lines in the sand.

“Banks would never put banking on a phone.”

“Banks would never allow non-banks to initiate payments.”

“Banks would never put core data in the cloud.”

In each instance, the “never” wasn’t a statement of impossibility; it was a statement of preference. It was the sound of an industry wishing that the laws of physics—or at least the laws of commerce—would stop changing. But the market always moves, and the “never” eventually becomes the “now.”

Today, we are hearing the phrase again. As we navigate the noisy transition from the Information Age to the AI Age, the banking sector is once again drawing lines in the sand. We see it in the skepticism toward programmable money, the resistance to shared data standards, and the fear of autonomous agents.

Currently, most institutions are caught in a trap of “innovation theater.” On one side, they are running pilots with crypto assets—often driven by FOMO (Fear Of Missing Out) rather than strategy. On the other side, they are spending billions to update legacy messaging standards (like ISO 20022), essentially trying to teach old mainframes to speak slightly better grammar.

Both approaches miss the point. The next great leap in banking isn’t about buying Bitcoin, and it isn’t about sending richer text messages between silos.

The real revolution is structural. It requires upending the fundamental “laws of physics” that bankers have relied on for decades. It demands a shift from passive custody to active programmability; from siloed reconciliation to cryptographic verification; and from serving only humans to serving the autonomous economy of the future.

To survive this transition, leadership must confront the uncomfortable truth: the greatest risks to your institution today are not the regulations or the fintech competitors. The greatest risks are the five things you currently believe you will never do.

2. The Product Shift: From Static Deposits to “Programmable Liabilities”

The first “never” strikes at the heart of the banking balance sheet.

The Old Rule: “Banks would never let a deposit manage itself.”

For 500 years, a bank deposit has been a noun. It is a static record—a row in a database that sits quietly, doing nothing, until a human or a scheduled batch process instructs it to move. The bank’s role has been that of a warehouse: we store the value, and we wait for instructions.

But in a digital economy that operates 24/7/365, static money is becoming an operational bottleneck. The “never” here is the resistance to surrendering control over the logic of the money. Banks have historically preferred to keep the logic (the payment rails) separate from the value (the deposit).

The New Reality: Money as a Verb

The future belongs to Programmable Liabilities. This is the shift from “passive money” to “active money.”

Imagine a corporate treasury account that doesn’t just sit there. Instead, the liability itself carries executable logic. When a payment arrives, the money “wakes up” and automatically splits itself: 25% to a tax holding account and 75% to company’s operating capital and liquidity reserves.

Or consider a supply chain payment that is conditional not on a manual approval, but on the digital receipt of goods verified by a third-party logistic provider’s data feed.

This is not science fiction; it is the promise of Commercial Bank Digital Currency (CoBDC) done right. It transforms the bank deposit from a passive entry into a smart agent capable of executing context-specific complex business logic autonomously.

The Strategic Implication

Corporate treasurers are increasingly frustrated by the friction of moving cash. They are tired of “dead” capital that gets trapped in transit or requires manual reconciliation. They don’t just want to store cash anymore; they want cash that works.

If banks continue to offer only static storage, clients will look elsewhere. Stablecoins are already beginning to offer this programmability, albeit with higher risk and compliance issues. If a tech company offers a “smart dollar” that automates a treasurer’s workflow, and a bank offers a “dumb dollar” that requires manual spreadsheets, the choice will eventually become obvious.

The C-Suite Question

Leadership must ask: “Are we building a digital vault, or are we building an operating system for our clients’ capital?”

If the answer is just a vault, you are competing on price and yield—a race to the bottom. If the answer is an operating system, you are competing on value, stickiness, and the ability to solve your client’s most complex operational headaches.

3. The Architecture Shift: Verification Without Centralization

If the first “never” was about the product, the second is about the plumbing.

The Old Rule: “Banks would never trust a transaction they don’t control.”

This defensive posture is understandable. For decades, a bank’s ledger has been its fortress. The integrity of that database is synonymous with the bank’s solvency. The idea of relying on a “shared ledger”—like a public blockchain—feels like asking a bank to store its gold in a park bench.

This fear has trapped the industry in the “Casino Delusion.” Banks look at crypto rails and see a chaotic, unregulated casino where they have no control. Because they (rightly) refuse to run their core systems on public blockchains, they retreat to what they know: Silos and Messaging.

They continue to maintain isolated ledgers and update each other via SWIFT messages. I debit my ledger, I send you a text message, you credit your ledger. This separation creates the “reconciliation gap”—the black hole where billions of dollars in operational costs disappear every year, just trying to ensure that Bank A’s spreadsheet matches Bank B’s spreadsheet.

The New Reality: Shared State, Not Shared Ledger

The breakthrough here is subtle but profound. We must move beyond the binary choice of “My Ledger” vs. “Our Ledger.”

The third path is Cryptographic Verification (or Shared State).

In this model, banks do not need to share a database. They do not need to surrender their data to a consortium blockchain. Instead, they use cryptographic proofs to verify the state of a transaction with a counterparty.

Think of it as a digital wax seal. You can verify the seal is authentic and unbroken without needing to own the King’s signet ring yourself.

Using this architecture, a bank can prove to a counterparty that funds have been reserved or moved without revealing the rest of its balance sheet. This allows for real-time, atomic settlement across different institutions without a central intermediary or a clumsy blockchain network.

The Strategic Implication

This shift allows banks to achieve the “Holy Grail” of payments: instant global settlement with zero reconciliation, but without the loss of sovereignty that comes with blockchains.

It transforms the bank’s technology stack from a “store and forward” messaging system (like email) to a “state verification” system (like a secure tunnel). It eliminates the latency of trust.

The C-Suite Question

Leadership must ask: “Can we stop ‘messaging’ other banks and start ‘verifying’ data directly with them?”

If you are still just sending messages, you are paying for the past. If you are verifying state, you are building the real-time infrastructure of the future.

4. The Data Shift: Eliminating Reconciliation via “Structured Intent”

This “never” addresses the single largest sinkhole of operational cost in the financial industry.

The Old Rule: “Banks would never abandon the ‘messaging’ model.”

For fifty years, banking has operated on the “Four-Corner Model.” Customer A tells Bank A to pay; Bank A sends a message to Bank B; Bank B credits Customer B.

It sounds simple, but it is fundamentally broken. Why? Because the money (the payment message) travels separately from the meaning (the invoice, the contract, the shipping data).

Because these two streams of data are separated, banks and corporations spend billions of dollars every year on “reconciliation.” This is essentially the cost of hiring armies of people (and software) to glue the two streams back together at the other end. It is a tax on ambiguity.

The New Reality: Structured Commercial Intent

The solution is not faster messaging; it is better grammar. We are moving toward Structured Commercial Intent.

Instead of sending a generic payment message, we must structure transactions as linguistic sentences that bind the business logic to the payment.

Subject: Validated Identity (Who is paying?)

Verb: Explicit Intent (Why are they paying? e.g., “Settling Invoice #1234”)

Object: The Asset (What is being moved?)

In this model, the transaction is the legal agreement. The payment instruction contains the verified proof of the invoice and the identity of the sender, mathematically bound together.

The Strategic Implication

When data is structured this way, reconciliation becomes obsolete. It isn’t that reconciliation becomes faster; it’s that the problem ceases to exist. A computer does not need to “reconcile” a sentence to understand it; it simply reads it.

This allows banks to offer “straight-through processing” that actually goes straight through, not just for the payment, but for the client’s ERP system as well.

The C-Suite Question

Leadership must ask: “Why are we paying thousands of staff to check if Bank A’s spreadsheet matches Bank B’s spreadsheet?”

In a world of AI and structured data, manual reconciliation is an admission of failure. It is evidence that your data structure is broken.

5. The Revenue Shift: Monetizing the “Chain of Trust”

This “never” challenges how banks define their value proposition in a digital world.

The Old Rule: “Banks would never verify a customer for a competitor.”

Traditionally, banks view their Know Your Customer (KYC) and Anti-Money Laundering (AML) data as a fortress. It is a proprietary moat designed to keep customers in and competitors out. Furthermore, compliance is viewed strictly as a cost center—a tax on doing business that generates zero revenue.

Consequently, the industry spends billions verifying the same people over and over again. If a customer walks across the street to another bank, the entire expensive process starts from scratch.

The New Reality: The Fact Factory

In an age of deepfakes, bots, and AI-driven fraud, “Truth” is becoming the world’s scarcest commodity. The question “Are you a real human?” is suddenly valuable.

Banks are the best-positioned institutions in the world to answer that question. They are the “Fact Factories” of the economy.

The shift here is to monetize the verification itself. Instead of hoarding risk data, banks can issue Verifiable Credentials—cryptographically secure proofs of identity, solvency, or accreditation. A customer could use their bank-verified credential to onboard with a supplier, sign a digital contract, or access a gated network, all without the bank processing a payment.

The Strategic Implication

This decouples the bank’s role as a lender from its role as a verifier.

By becoming a “Trust Anchor,” the bank turns its heaviest compliance burden into a net-new revenue stream. Every time a customer uses their bank identity to interact with the digital world, the bank earns a micro-fee. The bank becomes the notary of the internet.

If banks refuse to do this, Big Tech will. Apple and Google are already moving to hold driver’s licenses and IDs. If they become the primary source of digital identity, banks will be relegated to the plumbing.

The C-Suite Question

Leadership must ask: “Are we in the business of selling loans, or are we in the business of selling truth?”

If you are only selling loans, you are fighting a race to the bottom on interest rates. If you are selling truth, you are owning the infrastructure of the future.

6. The Customer Shift: Delegated Authority for the AI Era

This final “never” forces banks to confront who—or what—their future customer actually is.

The Old Rule: “Banks would never let a machine sign for a human.”

Banking regulation and risk models are currently built entirely around biological humans and legal corporate entities run by humans. The system demands that a human authenticates every meaningful action—via a fingerprint, a password, or a mobile token.

Consequently, when an AI agent tries to execute a transaction today, the bank sees it as a threat. It looks like a bot, it acts like a script, so the bank’s fraud defenses block it.

The New Reality: Verifiable Delegation

We are rapidly moving toward an economy dominated by machine-to-machine commerce. Soon, your personal AI assistant will negotiate your travel bookings, and corporate AI agents will autonomously procure supplies.

If banks insist that a human must manually click “approve” for every micro-transaction, they will be bypassed.

The shift is not about giving robots rights; an AI cannot own property or be sued. The shift is about Delegated Authority.

Banks must build the cryptographic infrastructure that allows a human customer to say: “I authorize this specific AI agent to spend up to €100 of my money, but only for groceries, and only at these three merchants.”

This moves the bank from a binary security model (Authorized/Not Authorized) to a granular permission model. The AI becomes a verifiable proxy for the human will.

The Strategic Implication

This is the battle for the interface of the future. If a bank cannot recognize and process the authority of an AI agent, that agent will simply use a crypto wallet or a non-bank payment provider that does.

Banks that master this will capture the explosion of high-volume, low-latency transaction flows that the AI economy will generate. Banks that don’t will be left servicing only the slow, manual transactions of the legacy world.

The C-Suite Question

Leadership must ask: “When our client’s AI assistant tries to buy a service, will our bank block it as fraud, or recognize the client’s digital signature?”

In the very near future, blocking the bot won’t be “protecting the customer”—it will be firing them.

7. Conclusion: The “Dumb Pipe” Risk

These five “nevers” represent the difference between modernizing the facade of banking and modernizing the foundation.

Most “digital transformation” efforts in banking today are cosmetic. They are about building better mobile apps for the same old products (static deposits) running on the same old rails (messaging). This is like putting a touch screen on a filing cabinet.

The Fork in the Road

The industry now faces a binary outcome.

Outcome A: The Dumb Pipe

If banks continue to cling to their “nevers”—refusing to program money, refusing to share state, and refusing to verify AI agents—they will not disappear. Instead, they will become invisible.

They will become the plumbing: regulated, capital-intensive, low-margin utilities that sit silently behind the flashy interfaces of Big Tech. Apple, Google, and niche fintechs will own the customer relationship, the data, and the profit. The bank will simply hold the balance sheet.

Outcome B: The Trust Anchor

However, if banks embrace these shifts, they can claim a much more powerful role.

By transforming from custodians of money into custodians of truth, banks can become the operating system of the digital economy.

They will be the engines that power programmable commerce.

They will be the judges that verify identity in a sea of AI noise.

They will be the bridge that allows autonomous agents to trade safely.

The Final “Never”

The most dangerous sentence in your boardroom is no longer “We can’t do that.” It is “We would never do that.”

The technology to make these shifts exists today. It does not require a crypto casino, and it does not require tearing down your core banking system tomorrow. It simply requires a change in mindset.

Don’t just build a better bank. Build the Trust Layer.